Greenwood Concrete is excited to offer online payment and financing options through the U.S. Bank Avvance™ app! To get started, simply scan the QR code with your mobile device, or use the red buttons to make a payment or get pre-approved. You can also calculate your estimated monthly payment and see further info by clicking the “Pre-Approval” button.

Meet U.S. Bank Avvance™, a flexible consumer financing option that makes life’s purchases possible.

Whether your purchase is planned or unplanned, Avvance is an installment loan solution to help you finance purchases quickly and easily. We match you to loan options provided by U.S. Bank that are customized to your individual needs. It’s a quick, seamless application.

Avvance installment loans are:

- Affordable: low-to-no interest rate financing available

- Upfront: see qualified installment loan options before any impact to your credit score

- Flexible: choose your payment terms

- Simple: quick to apply for and easy to manage with autopay

- Transparent: no hidden fees

Flex your finances

What is Avvance?

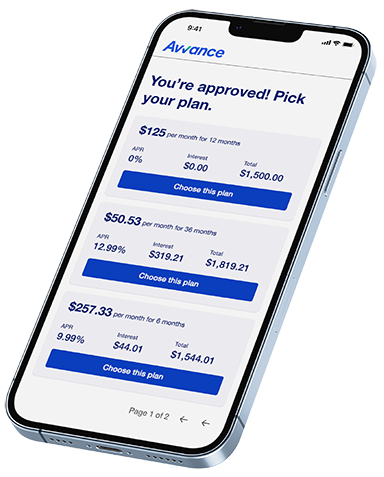

Avvance is an installment loan solution to help you finance your purchases. You can see qualified installment loan options before any impact to your credit score. Choose the option that works best for you, right from your device.

How does it work?

When you receive your invoice via email, visit our website and click “make a payment”. The accepted payment methods include Avvance point of sale lending. When you choose Avvance, you’ll be prompted to fill out an application for real-time approval. If you qualify, select one of the offered installment loans. We’ll pay the merchant for the purchase, and you’ll pay your monthly installments to U.S. Bank.

Does this involve a credit check?

After entering your information, we will run a “soft” credit check and you will be shown the loan terms you qualify for. If you decide to proceed with an installment loan, we may run a “hard” credit check which will impact your credit file.

How do I manage installments?

After selecting your loan, you can enroll in online banking to manage monthly installments, check balances, get statements and make monthly payments.

Pay it your way.

Don’t want to pay it all today? You don’t have to. We offer U.S. Bank Avvance™, a consumer installment loan solution to help you finance your purchases.

Questions? We’ve got answers.

Avvance is an installment loan solution to help you finance your purchases. You can apply quickly and easily online. If approved, you can see qualified installment loan options before there’s any impact to your credit score and choose the option that works best for you.

When you receive your emailed invoice, you can see accepted payment methods after selecting Pay invoice. If you qualify to finance with Avvance, you’ll be given several installment loan options to choose from. Then we pay the merchant directly and you pay in monthly installments.

Avvance is available with participating businesses in the U.S. only.

Right now, Avvance installment loans are only available with participating businesses. If a merchant offers Avvance as a payment option for their goods or services, you’ll see the option to apply on your invoice.

Your loan balance and other account details can be viewed on your account dashboard.

To get to your account dashboard:

- Log in to your U.S. Bank account in the app or through online banking.

- On your dashboard, you’ll find Loans, lines and leases.

- Choose the Avvance installment loan you want to view.

- On your Avvance account dashboard you’ll find your account balance and more.

Paperless notifications are offered for all Avvance installment loans. Your e-statements will be available for the duration of the loan.

To find your latest e-statement:

- Log in to your U.S. Bank account through the app or online banking.

- On the right-hand side of your Customer dashboard, you’ll find Shortcuts.

- Choose View statements.

We provide digital statements instead of mailing monthly paper statements. However, if you’d like to request a hard copy of any loan document or statement, please contact U.S. Bank Avvance Customer Service at 800-210-2364. We accept relay calls.

Feel free to update your profile at any time. Follow this helpful step-by-step guide on how to make updates in the U.S. Bank Mobile App or online banking.

As soon as your loan is paid in full, your account will be closed.

After you submit your loan application, we do an assessment to see what loan options you may be eligible for. This is the eligibility check.

Through this assessment a few different variables are considered, such as loan options offered by the merchant, the total amount of the purchase and your credit report. Then we can provide you a preview of the loans that may be best for you.

Yes, applicants must:

- Be at least 18 to apply.

- Be a resident of the U.S. or U.S. territories.

- Have a Social Security number.

- Have a U.S. registered mobile phone number that can receive text messages.

Although not an all-inclusive list, these factors may also affect your loan assessment:

- Credit score

- Credit use

- Payment history with U.S. Bank including overdue payments, deferred payments and loan delinquency

- Number of Avvance installment loans you currently have

- Income and debt verification

- Any recent bankruptcy filings

There’s no guarantee that every application will be approved. If your application isn’t approved, you’ll be notified immediately and receive a letter in the mail explaining the decision.

For more information on the approval process, feel free to contact U.S. Bank Avvance Customer Service at 800-210-2364. We accept relay calls.

It typically takes just a few minutes. We’ll provide loan options as soon you submit your application. When you choose your loan you can confirm and complete your purchase.

We’ll need to collect personal information including:

- Date of birth

- Social Security number

- Address

- Mobile phone number

- Annual income

Rest assured, the application process is secure and none of your information will be shared or distributed.

Giving your information to see what offers you’re eligible for will not affect your credit score. After choosing a loan offer, we may request a full credit report, which could impact your credit score.

U.S. Bank reports any loans to credit bureaus at the end of each month. If you’ve had any late payments or missed payments, those may be reflected and impact your credit report. If you believe an error has been made or inaccurate information has been reported, you may submit a dispute in writing to U.S. Bank.

To help us assist you in processing the dispute, you must include:

- Your name

- Mobile phone number

- Avvance installment loan account number

- Specifics on what’s being disputed

- Explanation of what needs to be corrected and why

- Any supporting documentation, if applicable

Send your written dispute to:

U.S. Bank NA Consumer Recovery Department

ATTN: CBR Disputes

P.O. Box 108

St. Louis, MO 63166-0108

We’re sorry to hear you need to dispute your purchase. First, we recommend contacting the merchant associated with the loan to resolve any issues. If you’ve already contacted the merchant and haven’t received support on the next steps, we may be able to open a dispute on your behalf. Keep in mind, disputes can only be opened within the first 120 days of the original purchase.

To make a dispute, call U.S. Bank Avvance Customer Service at 800-212-2364. We accept relay calls.

Dispute process:

- When a dispute is made, you and the merchant will be asked to provide supporting evidence for the claim and an investigation will be opened.

- We’ll let you know if provisional credit will be applied to your account and when you can expect it.

- While the investigation is underway, we’ll let you know if you need to continue to make the loan payments on your account. Not making payments when required could result in delinquent notices and impact your credit score.

- After the investigation, we will notify you of the resolution. This may take up to 90 calendar days.

- If the resolution is found to be in your favor, the provisional credit will remain on your account.

- If the resolution is found to be in the merchant’s favor, your original loan agreement and payment schedule will continue.

You will be mailed updates throughout the process to keep you updated on any additional information needed or any new developments to your dispute. For security, letters are sent in unmarked white envelopes.

We will work as quickly and efficiently as possible throughout the process.

To make a payment on your Avvance installment loan, you can:

- Set up on your account.

- Make a one-time payment through the U.S. Bank Mobile App or online banking.

- Call U.S. Bank at 800-210-2364. We accept relay calls.

- Mail a check to:

U.S. Bank Avvance Service

P.O. Box 790408

St. Louis, MO 63179-0408

You can pay through your checking or savings account by linking your account to transfer funds. You can also pay over the phone or by mailing a check. At this time, you may not use a credit or debit card to make a payment on your Avvance installment loan.

Personal checks, money orders, MoneyGram and cashier’s checks are accepted.

All checks are processed based off of the date they’re received. After receipt it can take up to 5 business days to process.

To help make sure your payment is timely, make sure to account for mail delivery time when mailing your check. Also include your account number in the check memo line. It will take longer to process if your 16-digit account number isn’t included.

To set up autopay in the U.S. Bank Mobile App:

- Find the Loans, lines and leases section in your customer dashboard and select your Avvance installment loan.

- Select Set up autopay.

- Choose which account you’d like to use to make payments, then select Save and Start autopay.

To set up autopay through U.S. Bank online banking:

- Log in to online banking.

- Choose your Avvance installment loan on your dashboard under Loans, lines and leases.

- On your Avvance installment loan account dashboard, choose Set up autopay.

- Choose which account you’d like to use to make payments.

- Then, choose Start autopay.

When you’ve finished setting up autopay, make sure to review the terms of service. It can take up to four weeks to initiate autopay.

Yes, you can update your payment method through the U.S. Bank Mobile App or online banking.

From the U.S. Bank Mobile App:

- Go to Pay bills at the bottom of the dashboard.

- Choose Pay a bill.

- Select which bill you’d like to update.

- Choose the balance displayed.

- On the next screen, choose the Pay from field.

- Update to the new account you’d like to pay from.

- Select Save.

From online banking:

- Log in to U.S. Bank online banking.

- Go to Bill payments at the top of the page.

- Choose Pay bills & U.S. Bank accounts.

- Choose which bill you’d like to update.

- Then, find the account it’s paid from.

- Use the dropdown menu and choose the new account to pay from.

- Select Done.

Please note, if a transaction is currently pending, it won’t be eligible to change.

No, there are no penalties for paying off your loan early.

Yes, any additional funds will go toward your total balance. This could mean you make fewer monthly payments, have a smaller final payment or both. This could also mean you could save on any interest that hasn’t accrued.

No, unfortunately payment due dates can’t be changed. You can always make a payment or schedule a payment before the payment due date, but you can’t change the payment due date itself.

If you miss a payment, a late fee is issued to your account. Missed payments are reported to the credit bureau and may impact your credit score.

We understand mistakes happen and sometimes payments get missed. That’s why we recommend setting up autopay for your Avvance installment loan.

It’s important to not be delinquent on your loan payments. U.S. Bank will send notices informing you of late payments, any associated late fees and notice of a potential charge-off.

Having a charge-off associated with your account may have serious consequences for your credit history and your future borrowing ability. Any payment past due by 120 days or more is subject to a charge-off.

Any payment made that is less than the monthly amount due by the payment due date is subject to a late fee.

We’re happy to help you with any payment issues, questions or concerns. Please contact U.S. Bank Avvance Customer Service anytime between 6 a.m. to 7 p.m. CT at 800-210-2364. We accept relay calls.

There are both fees and interest charges associated with Avvance installment loans.

Fees:

- If a payment is past due, the loan is subject to late fees.

- If a payment is returned, whether it be for insufficient funds, invalid information or another reason, there will be a returned payment fee.

Interest:

- There may be an APR (annual percentage rate) applied to an Avvance installment loan. Your APR may be different depending on what the merchant offers. The exact purchase terms will be shown to you before you confirm your Avvance installment loan.

- There is a finance charge associated with an Avvance installment loan. The finance charge is the total interest amount accrued under the terms of the loan. This will be given during the application process.

We’re happy to help resolve payment issues or concerns. Please give U.S. Bank Avvance Customer Service a call at 880-210-2364.